-

International Financial Reporting Advisory Services

IFRS reporting advisory serivces of Grant Thornton are carried out by our dedicated team with expertise…

-

Audit Services

• Statutory audit • Review of financial statements and financial information • Agreed-upon procedures • FRAS…

-

Audit Quality

We have various methods of monitoring our system of quality control and engagement quality,…

-

Audit Approach

Audit Approach

-

Licensing services

Licensing services

-

International tax planning

Our extensive international network provides us with significant resources to meet all your expansion goals.…

-

Expatriate tax planning

We have a broad knowledge base and skills to assist you keep your personal income taxes to a…

-

Tax advisory

We will review the proposed business model and transactions and advise on tax implications and…

-

Tax compliance services

This service is designed to assist enterprises to cope with the statutory tax declaration requirements in…

-

Tax health check

Our Tax Health Check involves a high-level review of specific tax areas to highlight the key issues…

-

Transfer Pricing

Transfer pricing is a pervasive tax issue among multinational companies. In Vietnam, the tax…

-

Tax due diligence

We conduct tax due diligence reviews of target companies to analyse their tax exposure and…

-

Customs and international trade

Our experienced professionals can help you manage customs issues more effectively through valuation…

-

M&A Transaction

We advise numerous foreign investors on efficient tax structures for their investments. Our…

-

Industrial Zones – Picking A Location For Your Business

Grant Thornton Vietnam’s one-stop services are designed to provide comprehensive support to both…

-

Tax Audit Support

Tax audit support services provide comprehensive assistance to your business in Vietnam. Recent tax…

-

Business Risk Services

Business Risk Services

-

Transaction Advisory Services

Transaction Advisory Services

-

Valuation

Valuation

-

Business consulting services

Finance Management Advisory

-

Accounting services

Accounting services

-

Taxes compliance within outsourcing

Taxes compliance within outsourcing

-

Payroll, personal income tax and labor compliance

Payroll, personal income tax and labor compliance

-

Secondments/Loan staff services

Secondments/Loan staff services

-

Compilation of the financial and non-financial information

Compilation of the financial and non-financial information

-

Accounting systems review and improvement

Accounting systems review and improvement

-

Initial setting-up for accounting and taxes systems

Initial setting-up for accounting and taxes systems

-

Management accounting and analysis

Management accounting and analysis

-

Comprehensive ERP system solution

ERP software is a tool for business operations, production management, order processing and inventory in the business process. Today, ERP software for small and…

-

Analyze Business Administration data

We believe in the value that data can bring to the success and development of every business. Our team helps design data architecture supported by tools, to support…

-

Financial reporting compliance solution package

Putting financial issues at the heart, this service helps ensure that financial reports for customers comply with both the requirements of Vietnamese accounting…

-

Third-party ERP extensions

ERP is a long-term solution that requires long-term travel, not short-term. We understand that many businesses cannot deploy the entire ERP system at once due to…

-

Localize, deploy and rebuild the project

Quite a few ERP projects need to be implemented according to current Vietnamese requirements and regulations, but still comply with common international…

-

Consulting on technology solutions

We support the selection and implementation of the most suitable solutions, ensuring business efficiency and performance. We will work closely with customers to…

-

Offshore company establishment service

Using the offshore company model will facilitate the owner in the process of transaction and expand…

-

Private Trust Advisory

The development of the economy with many modern financial instruments has brought many…

-

Our values

We have six CLEARR values that underpin our culture and are embedded in everything we do.

-

Learning & development

At Grant Thornton we believe learning and development opportunities help to unlock your…

-

Global talent mobility

One of the biggest attractions of a career with Grant Thornton is the opportunity to work on…

-

Diversity

Diversity helps us meet the demands of a changing world. We value the fact that our people come from all…

-

Contact us

Contact us

-

Available positions

Experienced hires

-

Available positions

Available positions

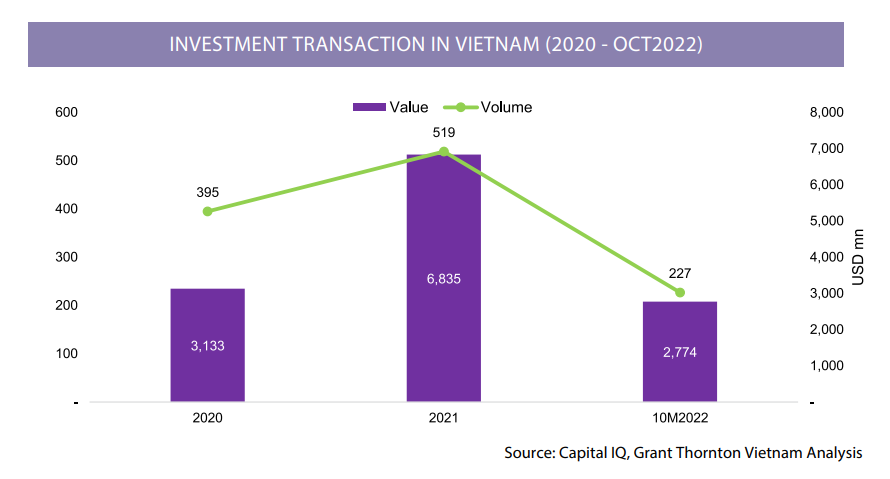

Notably, despite the limitations of the pandemic, Vietnam’s investment market hit a record year in 2021, both in terms of transaction value and volume, as evidenced by 41 per cent on-year growth in deal volume and 37 per cent increase in deal value from 2020. This jump was driven by sustained efforts to attract foreign investment and Vietnam’s economic stability.

However, the picture of the Vietnamese investment market in the first 10 months of 2022 failed to impress. The period recorded only 227 deals, marking a decrease of 42 per cent in deal volume and 29 per cent in transaction value compared to the corresponding period of 2021.

The Vietnamese investment activity downtrend in 2022 to that point has mirrored the current global investment market. According to Refinitiv data, global investment in the first half of the year was down 21 per cent by value and 17 per cent by volume compared to the same period the previous year, due to inflationary pressure, rising interest rates, and the Russia-Ukraine war.

The majority of investment activities since 2020 were from private companies, including both venture capital (VC) and private equity (PE), reaching $8.5 billion, equivalent to 66 per cent total value of completed deals. In terms of deal size, the most common ticket size among venture capital investors, according to our observation, is $1-3 million while PE buyers prefer larger deal sizes ranging from $5-30 million.

We also observed that the preferred exit methods in Vietnam's market are through trade-sales and secondary buyouts, while initial public offering is no longer a preferred option as it used to be several years ago. This would probably be the result of unstable capital markets, especially during the perceived uncertainty for the global economy.

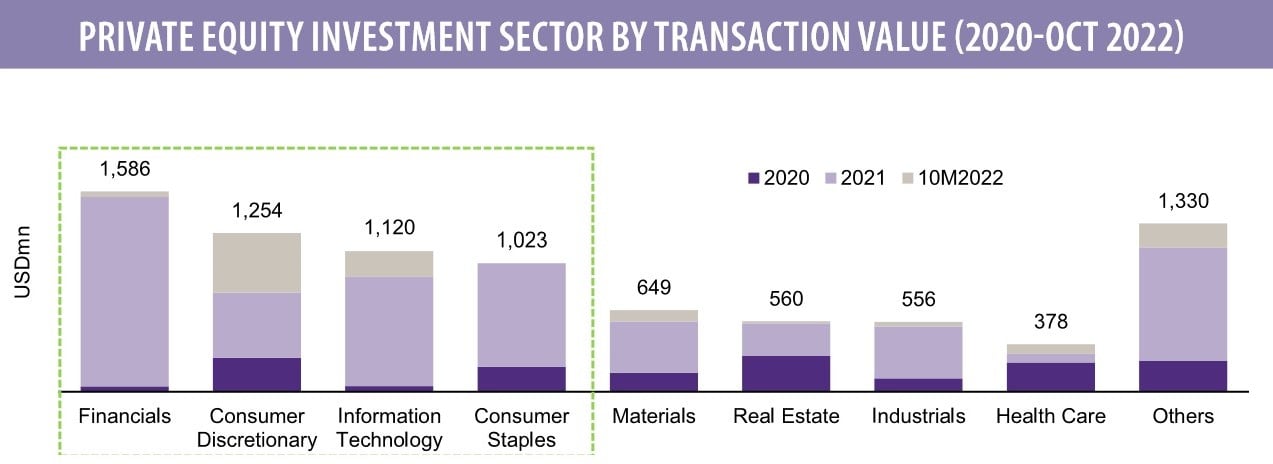

Key sectors for PE Investment

By volume, the industrial, IT, and consumer discretionary sectors were the three most targeted.

Despite being the most attractive sector by volume in 2020 and 2021, industrials dropped from 81 deals in 2021 to only 28 deals during the first 10 months of 2022, worse than 2020’s performance of 72 deals.

Consumer discretionary continued to receive increasing interest from investors with deal volume ranging from 23 to 36, while tech deals also maintained their uptrend momentum thanks to investment themes related to online payment, e-commerce, and blockchain. It saw 26 deals in 2020 and this increased to 42 deals in 2021 and 34 deals in the first 10 months of 2022.

In terms of value, finance, consumer discretionary, IT, and consumer staples are the top areas that attract private investment, accounting for roughly 60 per cent of total transaction value.

Notably, 2021 witnessed large deals in the financial sectors, with a focus on consumer finance businesses.

The largest PE investors

During the last three years, the largest PE investors in terms of transaction value were all overseas players from Asia, including SMBC Consumer Finance Co., Ltd, GIC Private Limited, SK South East Asia Investment, Alibaba Group Holding Limited, Baring Private Equity Asia, Mizuho Bank Ltd., KKR&Co, with average deal size of $400 million.

Previously, investment activities were dominant by foreign investors but this situation has changed significantly as local players are more actively involved in transactions. Since 2020, local players participated in over 500 transactions with a total value of more than $4.8 billion, accounting for 44 per cent by volume and 38 per cent by value of Vietnam’s total investment market.

In PE their participation also cannot be ignored. From our observation, local investors have started to tap into the PE market, although their activity has been moderate compared to foreign peers. Since 2020, Vietnamese-based investors were involved in 240 deals with a total deal value of over $1.9 billion, representing approximately 30 per cent and 23 per cent by volume and value respectively.

Venture Capital activities

The largest VCs in Vietnamese market are mainly overseas funds, namely Genesia Ventures, Y Combinator Management, Wavemaker Partners, FEBE Ventues, Jungle Ventures, and Venturra Capital, with average deal size at $4 million. Jungle Venture had the largest total transaction value ($103 million) as well as the average deal size ($15 million).

A larger-than-average transaction value of Jungle Venture was contributed by investments into KiotViet ($45 million) and Global Online Financial Solutions Ltd. ($20 million), where Jungle Venture co-invested with other funds.

Some active domestic players entering in venture capital market include Do Venture, Mekong Capital, and VinaCapital Ventures. Mekong Capital had lesser deal counts but a much larger average deal size than Do Ventures. Our observations show that Mekong Capital prefers to invest in companies that have at least one year of operations and typically invests in companies with annual revenues between $3-10 million, and annual net profit between $300,000 and $2 million in the year it makes the investment.

Vietnam Investment Outlook

Despite the challenges in the global and domestic investment environment such as the soaring inflation, rising interest rates and looming recession, the outlook for investment in the Vietnamese market is expected to be still bright in the medium and long term and there are several factors for this: Firstly, Vietnam’s economy is dominated by small and medium-sized enterprises with 98 per cent of market share and contributing to 47 per cent of national GDP. However, SMEs still face difficulties in accessing finance.

Vietnam has been regarded as an attractive investment destination by foreign investors thanks to the reform of legal framework to allow wider access to them. Moreover, the lifting of foreign ownership limits, the clearer and more favorable policy on capital gains and corporate income tax, also help to make Vietnam a more attractive investment destination.

Thirdly, equitisation of stateowned enterprises, after slow pace in prior years, is expected to gain momentum and will offer a large pool of investment opportunities for both foreign and local investors in the coming years.

Sector watch for new M&A deals

- Renewable energy: Vietnam needs to massively increase its renewable energy capacity, particularly solar and wind. This will require substantial investment, estimated over $11 billion per annum, according to the most recent iteration of Vietnam’s Power Development Plan VIII, much of which will be allocated for renewables. Maintaining the rapid expansion of renewable investment offers a promising opportunity for investment going forward, especially private investment owing to a variety of unlisted renewable energy players.

- IT is expected to continue to impress thanks to the government’s incentives in digital transformation among Vietnamese enterprises and the fact that Vietnam has shown its potential to become the next tech startup hub. In recent years, the startup ecosystem has evolved, making it more convenient for the growing technology start-ups.

A strong technology talent pool coupled with a growing entrepreneurial mindset also play an important role in transforming the Vietnamese tech industry. Digital payments will continue to develop as the government is pushing digital transformation, along with the growing young population and tech-savvy consumers.

- Consumer discretionary may continue to act as one of the key sectors for investment, as Vietnam has one of the fastest growing middle classes and a young population with 54 per cent population aged below 35 and growing disposable income.

- Environmental, social, and governance (ESG): in the last few years there has been growing investor interest in ESG factors when considering investments as it can affect the long-term performance of the business. ESG evaluations are expected to be integrated into investment deals by foreign investors’ dealmaking decisions. Coupled with the Vietnamese government’s commitment to reach its net-zero-carbon emission target by 2050, domestic businesses are likely to follow this theme.

By M&A Advisory Team

Grant Thorrnton Vietnam