US created ripples in the global trade by levying steep tariffs on trade valuing billions of dollars from various countries including China. Increased tariffs might lead to relocation of global supply chain to escape from the tariffs on Chinese originating goods.

As per the international trade data compiled by US Census for Year 2018, US imported from China around USD 540 billion while it exported only around USD 120 billion, leading to a trade deficit of USD 419 billion. The trade deficit which is an economic measure of international trade indicates that US is net importing country with its trade with China. This has become bone of contention between the two nations.

The Tariff war would prove detrimental to China as it is net exporting country to US trade. The MNCs in USA may try to absorb some of the incremental tariff cost and pass on rest to end consumers. This will increase the cost of doing business for Chinese suppliers in China and may not be sustainable in long term.

The MNCs may explore various economic options to sustain in business. One of the strategies that is widely speculated is shifting of manufacturing base to other countries such as Vietnam, Bangladesh, Myanmar, etc. This would result in permanent business loss for China in favour of other Asian countries.

USA imposed increased tariff on China in sometime early months of 2018, since then lot of traction was observed in Vietnam market. Below is the comparison of US import from Vietnam:

All figures are in millions of U.S. dollars

All figures are in millions of U.S. dollars

The export from Vietnam to USA has shown a spike by 38.37% which is commendable. Building capacity and infrastructure generally takes time, the ball is in court of business houses and government of Vietnam as to how fast they grab this opportunity.

The increased export not only benefits the exporters based out Vietnam but has cascading effect in the economy. The increased export may have direct impact on the exporters, at the same time it would also impact the economies of other dependent industries such local tool manufacturers, raw material suppliers, hospitality industry, etc. This is a wave which if Vietnam sails through would make it a manufacturing hub of the region.

Shifting of global supply chain

Vietnam has established manufacturing hub and have the required infrastructure, technical resources, low wages and being a neighboring country makes it a natural choice. Therefore, cost of relocation to Vietnam may not be high.

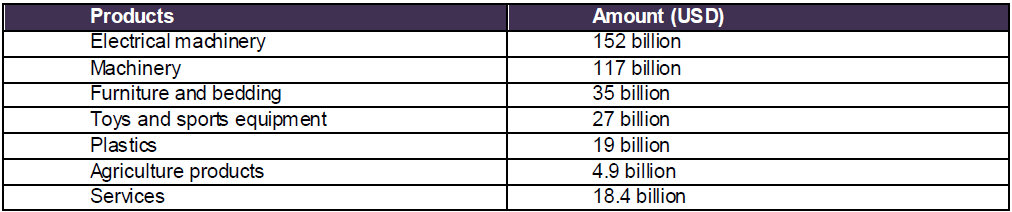

Further, digging down the statistics, available on Office of the United States Trade Representative, below is the major import by USA from China in year ending 2018:

From the above table, it may be construed that the major traction could be observed in electrical machinery and other machinery industry. Looking at the aggressive position adopted by US, the pain may sustain longer or may be permanent as well. This would lead to influx of international transaction between China-Vietnam and Vietnam-USA and have several transfer pricing implications. The typical transaction pre and post structuring in above industry would be as below:

Transfer pricing implication

Transfer pricing is an important issue for MNCs in designing their global supply chains, pricing international transactions and managing their transfer pricing risks. Any such international transactions need to be tested with regards to arm’s length standard. Some of the typical inbound transfer pricing issues with respect to machinery industry that a taxpayer needs to carefully analyze are discussed in subsequent paragraphs.

- Shifting of client contracts

The US is curtailing on any Chinese originating goods, therefore, one of the typical issues from transfer pricing perspective would be shifting of client contracts (i.e. client IP) to Vietnam along with manufacturing base. Going forward the contracts with US parties would be negotiated and entered into by Vietnamese entity. The Chinese tax authority may require that such one-time transfer of client IP should be at Fair Market Value.

Proper due diligence could safeguard taxpayer in justifying that the transaction was neither sham nor tax motivated. Further, commercial rationale needs to be established and that there was no attempt to move profit generating client IP to other jurisdiction under artificial arrangement. It may be imperative to note that such transfer of IP should also have corresponding shift of FAR. In absence of satisfactory documents Vietnamese tax authority may disallow the entire payment for acquiring such IP.

- Purchase of materials

In order to maintain similar quality standards for goods, the Chinese entity may export raw materials, semi-finished goods for manufacturing in Vietnam. The tax payer should prepare proper segmentation segregating between related party and third party business. The segmentation should be based on actuals and in case of common cost pool, on appropriate apportionment basis.

Further, the selection of tested party would play critical role. Vietnamese entity would perform all the major functions pertaining to manufacturing, in contrast, China may perform only functions pertaining to supply of materials. In such scenario, the tested party would be Chinese entity performing simpler functions and Vietnamese entity would be the entrepreneur undertaking relatively complex functions. The taxpayer should maintain the computation of cost details and cost plus markup charged by Chinese entity before it sells to Vietnam. Therefore, comparability analysis undertaking Chinese entity may be more appropriate.

- Licensing of IP

Vietnam typically has the required infrastructure to carry out manufacturing activity but may not have the desired technology, know-how. In such a scenario, China may license its pre-existing IP to Vietnamese entity for manufacturing. The contract would be entered between Vietnam and USA for supply of goods while China may still be benefitted with licensing of technical IP, know-how to Vietnam. This would ideally compensate Chinese entity for some of the business loss.

It would be pertinent to note that, legal ownership of intangibles by Chinese entity alone does not determine entitlement to returns from the exploitation of IP. The entity performing important value creating functions related to development, enhancement, maintenance, protection and exploitation (“DEMPE”), exercise of control can expect corresponding returns. Therefore, the remuneration to Chinese entity would depend on the DEMPE functions performed by it.

The taxpayer needs to document what all manufacturing IPs are there for which payment is being made. Charging a royalty or licensing fee for the use of valuable know-how, technology processes, trade names should be buttressed with cost benefit analysis, evidence test, need test and an independent comparability analysis.

- Management support services

The entity at Vietnam may perform routine manufacturing functions. The Group CEO, CTO and key decision makers may be residing at China who would charge management fee for the supervisory functions it performs. Different type of intra-group services such as Technical, Finance, Accounting, HR, IT, etc would be typically provided within a group by Chinese entity.

The tax authority in Vietnam would be interested in knowing whether the payout commensurate with the benefit derived. Was the services duplicative or was the services really required to perform such functions. Whether such management support enhanced the commercial position of taxpayer. Such management fees need to satisfy the cost benefit test, evidence test, need test etc. If the taxpayer fails to document the above, the entire payment may be disallowed by the tax authority.

- Location Saving

As a result of relocation, MNC is expected to save on typical cost such as labour costs, raw material costs, rent, training costs, infrastructure costs. Location saving is the net cost savings that would be realized by an MNC as a result of relocating manufacturing functions, production, operation sites, etc from a high cost (i.e. China) to low cost (i.e. Vietnam) jurisdiction. The Taxpayer need to document the options realistically available to Chinese entity. The options realistically available, bargaining power of each entity, IPs are key in attributing location saving related return.

Conclusion

Considering, that the current tariff war is going to have far-reaching effect. It is advisable for MNCs to proactively undertake diagnostic review to analyze the impact on supply chain from transfer pricing perspective. Accurate delineation of transactions including contractual terms, the functions of the parties, commercial substance, risks is important. It would also be important to understand whether under an independent scenario a third party would be willing to undertake such transactions. The transactions should be at arm’s length and backed by robust documentation. The remuneration model should be aligned to value creation in the supply chain. For the transaction pertaining to IP, management support robust documentation would play critical role.

However, it would be noteworthy, that merely routing transaction vide Vietnam or putting “Made in Vietnam” tag to avoid tariff sanctions may not be sufficient as US may adopt aggressive positions in such artificial forms lacking commercial substance.