-

International Financial Reporting Advisory Services

IFRS reporting advisory serivces of Grant Thornton are carried out by our dedicated team with expertise…

-

Audit Services

• Statutory audit • Review of financial statements and financial information • Agreed-upon procedures • FRAS…

-

Audit Quality

We have various methods of monitoring our system of quality control and engagement quality,…

-

Audit Approach

Audit Approach

-

Licensing services

Licensing services

-

International tax planning

Our extensive international network provides us with significant resources to meet all your expansion goals.…

-

Expatriate tax planning

We have a broad knowledge base and skills to assist you keep your personal income taxes to a…

-

Tax advisory

We will review the proposed business model and transactions and advise on tax implications and…

-

Tax compliance services

This service is designed to assist enterprises to cope with the statutory tax declaration requirements in…

-

Tax health check

Our Tax Health Check involves a high-level review of specific tax areas to highlight the key issues…

-

Transfer Pricing

Transfer pricing is a pervasive tax issue among multinational companies. In Vietnam, the tax…

-

Tax due diligence

We conduct tax due diligence reviews of target companies to analyse their tax exposure and…

-

Customs and international trade

Our experienced professionals can help you manage customs issues more effectively through valuation…

-

M&A Transaction

We advise numerous foreign investors on efficient tax structures for their investments. Our…

-

Industrial Zones – Picking A Location For Your Business

Grant Thornton Vietnam’s one-stop services are designed to provide comprehensive support to both…

-

Tax Audit Support

Tax audit support services provide comprehensive assistance to your business in Vietnam. Recent tax…

-

Business Risk Services

Business Risk Services

-

Transaction Advisory Services

Transaction Advisory Services

-

Valuation

Valuation

-

Business consulting services

Finance Management Advisory

-

Accounting services

Accounting services

-

Taxes compliance within outsourcing

Taxes compliance within outsourcing

-

Payroll, personal income tax and labor compliance

Payroll, personal income tax and labor compliance

-

Secondments/Loan staff services

Secondments/Loan staff services

-

Compilation of the financial and non-financial information

Compilation of the financial and non-financial information

-

Accounting systems review and improvement

Accounting systems review and improvement

-

Initial setting-up for accounting and taxes systems

Initial setting-up for accounting and taxes systems

-

Management accounting and analysis

Management accounting and analysis

-

Comprehensive ERP system solution

ERP software is a tool for business operations, production management, order processing and inventory in the business process. Today, ERP software for small and…

-

Analyze Business Administration data

We believe in the value that data can bring to the success and development of every business. Our team helps design data architecture supported by tools, to support…

-

Financial reporting compliance solution package

Putting financial issues at the heart, this service helps ensure that financial reports for customers comply with both the requirements of Vietnamese accounting…

-

Third-party ERP extensions

ERP is a long-term solution that requires long-term travel, not short-term. We understand that many businesses cannot deploy the entire ERP system at once due to…

-

Localize, deploy and rebuild the project

Quite a few ERP projects need to be implemented according to current Vietnamese requirements and regulations, but still comply with common international…

-

Consulting on technology solutions

We support the selection and implementation of the most suitable solutions, ensuring business efficiency and performance. We will work closely with customers to…

-

Offshore company establishment service

Using the offshore company model will facilitate the owner in the process of transaction and expand…

-

Private Trust Advisory

The development of the economy with many modern financial instruments has brought many…

-

Our values

We have six CLEARR values that underpin our culture and are embedded in everything we do.

-

Learning & development

At Grant Thornton we believe learning and development opportunities help to unlock your…

-

Global talent mobility

One of the biggest attractions of a career with Grant Thornton is the opportunity to work on…

-

Diversity

Diversity helps us meet the demands of a changing world. We value the fact that our people come from all…

-

Contact us

Contact us

-

Available positions

Experienced hires

-

Available positions

Available positions

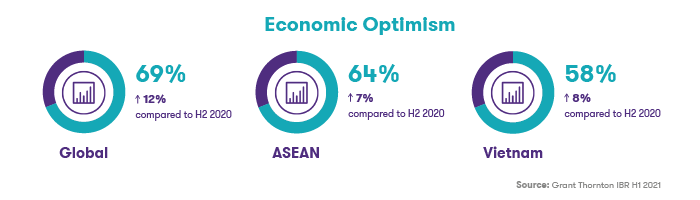

Our global research amongst SME’s in 29 countries (IBR), globally, has shown that outlook indicators have increased in H1 21 now surpassing pre-Covid levels. Double digit increases in the IBR outlook indicators were common across all regions, with most regions setting new records or returning to early 2018 levels. Expectations for exports are particularly strong, with just under 50% of firms expecting to increase exports in the next 12 months, which is encouraging firms to dedicate more resources to non-domestic markets and expand to new markets.

However, the rise in outlook indicators has been accompanied by a rise in “restrictions” on business such as access to finance, and cost of skilled labour and over 50% of firms (in our survey)now see restrictions as a constraint to business.

Economic optimism rose 12 percentage points (pp) in H1 21 on the back of a 14pp rise in H2 2020 and over 66% of firms are now optimistic about the economic outlook, now well above pre-Covid levels. Probably not surprising, employment expectations for the next 12 months are the strongest on record, whilst Revenue and Profit expectations have also increased strongly both up 12pp in H1 21.

However, despite the strong increase in business optimism, economic uncertainty remains an issue globally with 61% of firms citing ongoing uncertainty as a constraint to business. Businesses are also concerned about attracting the requisite skills in the labour market, which is reflected in rising labour costs. Over 53% of the firms also identified rising energy costs as a constraint representing an increase of 8pp over the last survey.

In ASEAN, economic optimism increased 7pp in H1 21 to 64% , slightly lower than the global average of 69%, however this is the highest level recorded in ASEAN since Q2 2018. Revenue and Profit expectations increased 7 and 9pp respectively but below the global figure of 12pp. Unlike other regions export expectations in ASEAN remained unchanged at 43% although this is in line with the global average. Unlike the global trend there is no expected increase in resources dedicated to non-domestic markets or in the number of markets. As in the global view companies in ASEAN are increasingly concerned about the availability of skilled labour.

Kenneth Atkinson, Founder and Senior Adviser of Grant Thornton Vietnam said: “In Vietnam, whilst mid-market companies displayed amazing levels of health, at the beginning of the pandemic compared to other countries in our survey this has been slowly deteriorating over the last 12 months. In the last 6 months companies have been impacted by worsening barriers to growth, primarily related to economic uncertainty and demand constraints, largely due to the continued outbreaks of Covid. There is some improvement in the general outlook but the elements are mixed with economic optimism and investment intentions strengthening and growth expectations weakening”.

Optimism is up by 8pp with 58% of mid-market companies now feeling optimistic, which is lower than the 64% in ASEAN. Whilst revenue and profit expectations have fallen by 5pp and 4pp respectively over 63% of the companies expect yearly increases in both. Whilst a little disappointing this is still above the ASEAN averages.

Vietnam has shown historic strength in export expectations but the most recent results have shown growth expectations falling by 10pp. This could be due to the timing of the survey which was conducted during the start of the most recent outbreak and the export expectations had increased 7pp in H2 2020.

Economic uncertainty has risen to its highest level on record with 68% of companies identifying this as a constraint to growth, whilst shortage of orders has been cited as a concern by 65% of the companies.

In terms of the impact of Covid on Vietnamese companies 59% reported a decrease in sales, whilst 54% cited a loss of business opportunities probably due to the continuing barriers to travel. 41% of companies had faced difficulties because of supply chain interruptions and 40% had experienced work force issue. Another popular challenge citied by 45% of the companies was challenges managing stakeholders.

When looking at Covid impact on EBITDA 39% of companies had experienced no change or an increase in 2020. A decrease of 1-9% in EBITDA was reported by 23% of the companies and 18% reported a decrease of 10-19%. 15% reported a negative impact of 20% or greater.

Approximately 90% of companies stated that they would be making major new investments in the coming 12 months. The top 4 categories for operating system investment were IT security management 55%, companywide IT infrastructure 49%, supply chain 46% and sales optimization and accuracy 44%. Interestingly 33% of companies were going to make investments into ERP systems.

Vietnam saw a record number of M&A transactions last year and 53% of our companies stated that they were considering M&A as a way of strengthening their business whilst 26% were considering M&A as a means of exiting the business.

Broadcasted on HTV

View video

Contact

For more information, please contact our expert. We are happy to support.