IFRS is one of the most popular accounting systems in the world (applied in over 140 countries and jurisdictions) which is encouraged to apply by financial management authorities in developed countries. The application of IFRS is expected to strengthen transparency and comparativeness of financial information among countries and support enterprises to approach capital markets, customers and suppliers more effectively, efficiently and economically.

By applying IFRS for reporting, enterprises in Vietnam might have the following benefits:

IFRS reporting advisory serivces of Grant Thornton are carried out by our dedicated team with expertise in IFRS implementation.

We bring together our technical knowledge and industry expertise, to address the financial exporting challenges of corporations and help them manage expectations of their stakeholders and regulators.

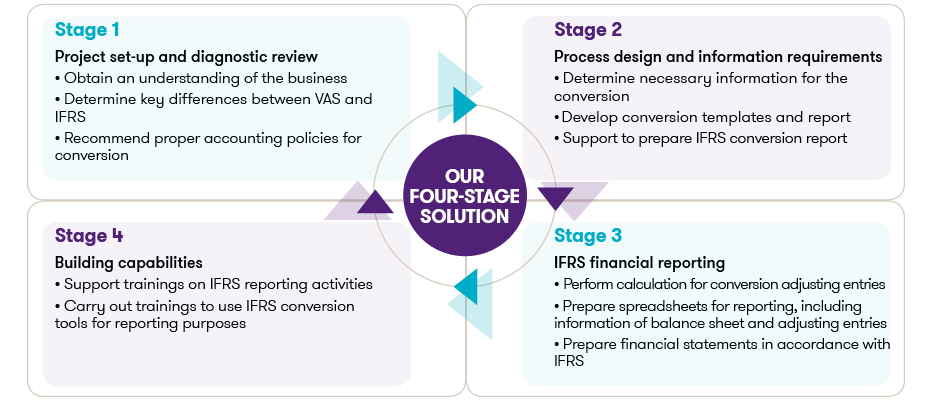

Our four-stage solution would benefit the clients with effective approach in IFRS conversion reporting and sustainable capacity builiding through our trainings and transfers of conversion techniques.

We support the clients to convert financial statements from VAS into IFRS and recommend accounting conversion solutions with more advantages to the entities. With our four-stage solution approach, we expect to maximize the clients’ benefits and minimize the conversion costs.

Benefits to the clients

-

- Use our tools for consolidation reporting process

- Use the standard IFRS report template

- Work with our local and international experts in IFRS

- Receive our support and trainings to accounting teams to improve IFRS conversion techniques

- High quality control by senior experts in IFRS

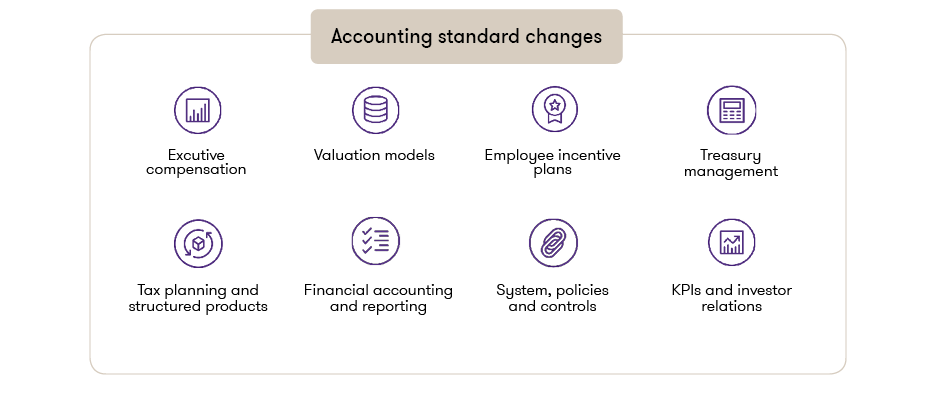

With some major changes recently to accounting standards such as Revenue recognition, Financial instruments and Leases, etc. Enterprises are looking at significant changes not only to their accounting policies, but also their operation models. Changes introduced by these standards will entail Enterprise wide changes to how to measure the Enterprise’s business performance and reflect its financial position.

Our solutions

-

- Review of existing contracts to identify impact under new guidance

- Perform computations for transition adjustments

- Suggestions on disclosures under new standards

- Training of finance team on the new standards

- Fund raising support activities

- Assistance in preparing IFRS financial information to be included in prospectus for IPO or capital raising

- Desktop review of IFRS financial statements for assessment of appropriate accounting policies

- Review of financial statement close process and identify areas of improvement

- Provide technical accounting support on new transactions (e.g. restructuring, if any)

- Assist in drafting responses to accounting and reporting comments provided by investors or stakeholders

- Ongoing accounting advice during independent audit support

- Transaction support activities

- Post-completion purchase price allocation accounting

- Evaluating accounting impact of a proposed divestment, acquisition or merger

- Advise on classification and measurement of complex financial instruments

- Advise on complicated standards such as IFRS 9, IFRS 15, IFRS 16, etc.

- Reviewing share-based compensation arrangements for potential accounting impact

- Accounting advice during independent audit support

This guidance is published by Grant Thornton Vietnam in order to assist Vietnamese entities in their transition from Vietnamese Accounting Standards (VAS) to International Financial reporting Standards (IFRS) when preparing financial statements.

Following the roadmap to adopt IFRS as per decision of the Ministry of Finance of Vietnam covering the period from 2022 to 2025, entities will have time to prepare for the conversion and understanding what is required. Although the expected day of mandatory adoption of IFRS is still relatively far away, timely preparation and making an implementation strategy will help the conversion to IFRS to be smooth and cost effective.

This guide focuses on summarising the key differences between VAS and IFRS to enable entities to make a first assessment of where significant differences are to be expected as well as instruction notes on when making the conversion. The guide is structured in summarising key differences in the requirements for overall presentation of the financial statements, the key differences of both the balance sheet and profit and loss as well as other important topics.

Follow our insight into this topic for more detailed instructions: Click HERE

IFRS 15 ‘Revenue from Contracts with Customers’, with effective date on 1 January 2018, replaces IAS 18 and IAS 11 and will affect almost every revenue-generating entity that applies IFRSs. IFRS 15 will apply to most revenue contracts, including construction contracts. Among other things, it changes the criteria for determining whether revenue is recognised at a point in time or overtime. IFRS 15 also has more guidance in areas where current IFRSs are lacking – such as multiple element arrangements, variable pricing, rights of return, warranties and licensing.

Five steps for revenue recognition:

- Identify the contract(s) with a customer

- Identify the performance obligations

- Determine the transaction price

- Allocate the transaction price to the performance obligations

- Recognise revenue when or as an entity satisfies performance obligations

Follow our insights into IFRS 15 for more detailed instructions.

https://www.grantthornton.com.vn/insights/articles/audit-and-assurance/ifrs/IFRS-15-revenue-from-customer-contracts/

IFRS 16 - Lease will affect most companies that report under IFRS and are involved in leasing, and will have a substantial impact on the financial statements of lessees of property and high value equipment. Accordingly, if a lessee can make the important decisions about the use of the asset in a similar way it makes decisions about the use of assets it owns outright, the lessee are required to recognise these rights on its balance sheet as a ‘right-of-use’ asset.

Follow our insights into IFRS 16 for more detailed instructions.

https://www.grantthornton.com.vn/insights/articles/audit-and-assurance/ifrs/insights-into-ifrs-16/

IFRS 9 fundamentally rewrites the accounting rules for financial instruments, introducing a new approach for financial asset classification and replacing the now discredited incurred loss impairment model with a more forward-looking expected loss model.

Under IFRS 9 each financial asset is classified into one of three main classification categories:

- amortised cost

- fair value through other comprehensive income (FVTOCI)

- fair value through profit or loss (FVTPL).

And each financial liability is measured at amortised cost or fair value.

Follow our insights into IFRS 9 for more detailed instructions.

https://www.grantthornton.com.vn/insights/articles/audit-and-assurance/ifrs/ifrs-news-special-edition-on-ifrs-9/

International Financial Reporting Standards (IFRS) is fast becoming the global accounting language. Over 100 countries have now adopted IFRS and many more have committed to make the transition in the next few years. The benefits of global standards are widely acknowledged. For companies, however, the conversion to IFRS is a major change both for the finance function and for the wider business.

In planning the conversion, management must develop a detailed and specific understanding of IFRS 1's implications on their business. Questions to consider include:

- When is retrospective restatement required and what will this involve?

- What are the exemptions in IFRS 1 and how should we decide which to take up?

- What information is needed in our first IFRS financial statements?

- How does IFRS 1 affect the timing of our conversion and reporting?

Follow our insights into this topic for more detailed instructions.

https://www.grantthornton.com.vn/insights/articles/audit-and-assurance/ifrs/a-practical-guide-to-ifrs-1-and-first-time-adoption/

Service Brochure

To view details: Click HERE